Contents

It is always fascinating and inspiring to see young blood working hard to bring a revolutionary change in the world through their startup business idea. Many startups begin from scratch in somebody’s garage or basement. We are all familiar with Apple and Steve Jobs. Well, guess what, he founded this company in his dad’s garage too. A few years ago, we couldn’t even imagine watching our favorite shows on the move. But, this was made possible because of someone’s revolutionary idea.

Constant advancement in the tech industry has enabled us a lot. Now you can access entertainment on your smartphone, just like I do with my Spectrum TV app. All these ideas go through the same cycle that begins with funding and ends in success.

All startups require funding to take off and become successful. You may have a great idea and an excellent team, but if you lack the money your business needs to take off, chances of failure increase by a lot. On the other hand, founders who have abundant cashflow and not a good team, still have a higher chance at success because they can afford to improve through trial and error.

How Startup Funding Works Today

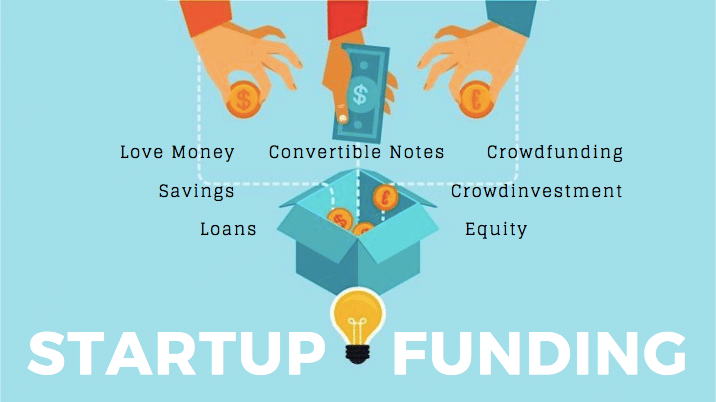

Once you have a great idea, you need to explore various avenues to generate the funding your business idea needs to succeed. There are many ways a startup company can get funding. The sources commonly used by startups nowadays are as follows.

- Personal Savings or Retirement Funds

A few businessmen who are lucky enough to have personal savings or retirement funds, typically use that money to fund their idea.

- Getting Loans

Entrepreneurs who don’t have any money of their own usually get loans from, friends, family, or a bank.

- Finding Grants or Funding Programs

There are many different types of funding programs and grants that provide huge sums of money to startup ideas. If nothing’s working out for you, find some grants or programs to apply for.

- Collaboration with Venture Capitalists

More often than not, startup businesses look for VCs (venture capitalists) who would invest in their business to make some profit in return. Such investors often provide money in exchange for getting some percentage of business ownership as a stakeholder.

- Finding Angel Investors

Even though the angel investors work more or less the same way VCs do, they are a bit more lenient in terms of having control over business decisions. Angel Investors are typically friends or family members or someone who wants to invest in your idea for a very small stake in the business.

- Acquiring Funds via Incubators and Accelerators

Other means of generating funds are through incubators or accelerators. They provide you with office equipment and space that your business needs. They also help you get in touch with the right people for investment.

- Initial Public Offerings (IPOs)

This is only a viable option when your business has grown enough. You can get your company listed on the stock market to raise funds through the public by letting them buy your company’s shares.

The Future of Startup Funding

The economic and cultural advancement has been consistently shaping the way startups generate funds for their business. Let’s take a look at what the future of startup funding looks like.

- The Influence of the JOBS Act of 2012

The Obama Administration passed the JOBS Act in 2012 to facilitate startups. This act allowed them to raise funding from small-time investors, also known as the Micro-angel Investors, in addition to the traditional sources (the Venture Capitalists). Investors who’d invest in startups could do so in exchange for equity, secure token offerings, or share in the startup’s revenue. In addition to that, this Act allows startups to offer up to $5 million in form of stocks without having to register with SEC.

- The Role of Angel-Investors

With the introduction of the 2012 JOBS Act, founders of startup companies have been given more control over who they can go choose as investors. Micro-angels are typically people who invest small amounts of money in a business ranging from $100 to a maximum of $5000. Up until almost a decade ago, such investors did not exist.

- The Impact of Crowdfunding

Almost a decade ago, the emergence of the idea of crowdfunding made us look at the future of startup funding with a different lens. With the passage of time and the advancement of technology, several crowdfunding platforms emerged to facilitate startups in generating funds. Kickstarter, Indiegogo, Patreon, and Crowdwise, etc. are a few examples of crowdfunding platforms that gained popularity over the years. If you want to find out more about them, you can surf the web as I did with my Spectrum Internet.

Let’s talk about how crowdfunding actually works. In its early stages, it was only used to help startups get enough money to launch their business model or create the prototype of their product. However, the founders were not allowed to give any stakes of their company to the people who were funding them. Things changed in 2016, and founders were legally allowed to offer small (ownership) stakes to their funders which are called equity in business terms. This meant that people who funded certain businesses would become stakeholders and get their share of the profit if the business flourished. The rules are quite strict and there are limits to how much one can invest in any startup but things may change over time.